Severe Convective Storm Loss Trends Highlight Need for Timely, Granular Data

Jeff Dunsavage, Senior Research Analyst, Triple-I (10/25/2023)

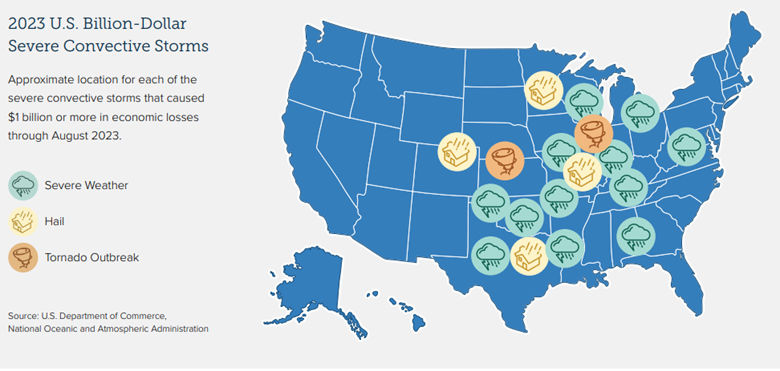

Severe convective storms are among the most common, most damaging natural catastrophes in the United States. The result of warm, moist air rising from the earth, they manifest in various ways, depending on atmospheric conditions – from drenching thunderstorms with lightning, to tornadoes, hail, or destructive straight-line winds.

A new Triple-I Issues Brief discusses 2023’s severe convective storm activity, which started early and has been an above-average year from a frequency perspective. The brief highlights the importance of timely, granular data for predicting and mitigating these complex perils.

As of late September, U.S. insured losses due to severe convective storms had exceeded $50 billion for the first time on record for a single year. Illinois has had the highest number of recorded tornadoes, beating out states like Texas and Oklahoma that traditionally top the nation. Hail and wind-related hazards drove most second-quarter losses, according to Gallagher Re, including “hundreds of instances of very large hail” that inflicted significant losses in densely populated areas around the Dallas-Fort Worth metroplex in Texas and Hot Springs in Arkansas, among other locations. In June alone, there were at least 349 reports of hail reaching and exceeding 2.0 inches across the United States and 89 reports of hail exceeding 3.0 inches. During the month, hail that approached or exceeded 4.0 inches pelted localities in at least 10 states.

Rather than the physical destructive force of natural catastrophes themselves, a Swiss Re study finds the main driver of high losses in recent years to be “economic growth, accumulation of asset values in exposed areas, urbanization and rising populations – often in regions susceptible to natural perils.”

Citing the prevailing inflation of the past two years, Swiss Re said, “The effect of high prices has been to increase the nominal value of buildings, vehicles, and other insurable assets, in turn pushing up insurance claims for damage caused by Mother Nature.”

All of which highlights the importance of closely monitoring exposures and loss experience and sharing such information within the industry.

“Lack of granular exposure data can also hinder understanding of all present-day risks,” Swiss Re says. “The fast rate of change of such variables necessitates shorter update cycles of data sets and models to mitigate risk accumulation and underestimation of loss trends.”

Want to know more about the risk crisis and how insurers are working to address it? Check out Triple-I’s upcoming Town Hall, “Attacking the Risk Crisis,” which will be held Nov. 30 in Washington, D.C.