Southern states brace for severe storms

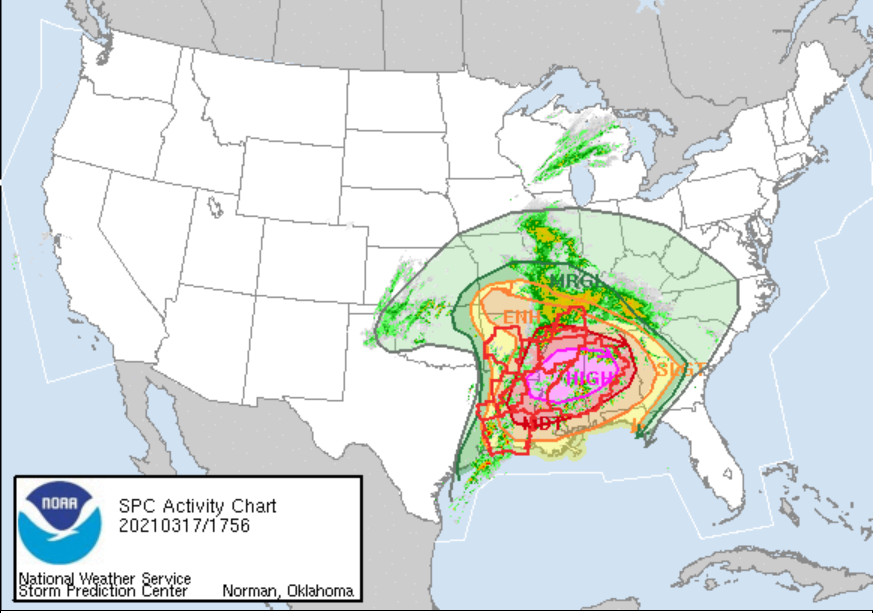

The Storm Prediction Center has issued its highest threat level forecast for severe weather, called a “high risk”, from parts of the lower-Mississippi Valley into Alabama. A dangerous tornado outbreak was underway in the Deep South on Wednesday afternoon, including the potential for long-track intense tornadoes as well as damaging winds and large hail.

“Property damage caused by tornadoes, hail, and strong winds are covered under standard homeowners, renters, and business insurance policies, and under the optional comprehensive portion of an auto insurance policy,” said Sean Kevelighan, CEO, Triple-I. ‘Insurance is the key to economic recovery for households and businesses impacted by severe weather.”

Should households or businesses incur property damage, policyholders should contact their insurer to access safely the assistance they need. Many insurer services are available via mobile app and online.

The Triple-I has these recommendations when property damage occurs:

Checklist for Renters, Home and Auto Owners

- Contact your insurance professional and start the claims filing process

- Take photos of any damage. A photographic record is useful when making an insurance claim.

- Make temporary repairs to prevent further loss from rain, wind, or looting; these costs are reimbursable under most policies, so save the receipts

- Compile a detailed list of all damaged or destroyed personal property. Do not throw out damaged property until you meet with an insurance adjuster. If you have a home inventory, it will make either the renters or homeowner’s claims-filing process easier

- Hold off on signing repair contracts. Do your due diligence, deal with reputable contractors, and get references. Consult your insurance adjuster before signing any contracts

- Check to see if you’re eligible for additional living expenses (ALE). Standard homeowners and renters insurance policies pay for the extra charges (e.g., temporary housing, restaurant meals) you incur over and above your customary living expenses if your home is uninhabitable because of an insured loss

Checklist for Small Business Owners

- Contact your insurance professional and start the claims filing process

- If your business is forced to close temporarily or relocate because of direct physical damage to its premises, file either a business income (interruption) or extra expense claim, if you carry these coverages

- To receive a business income settlement, document your net income and operating expenses, including payroll, both before and after the business was disrupted

- Keep detailed records of all business expenses and transactions as your business recovers