If It Can Rain, It Can Flood: Buy Flood Insurance

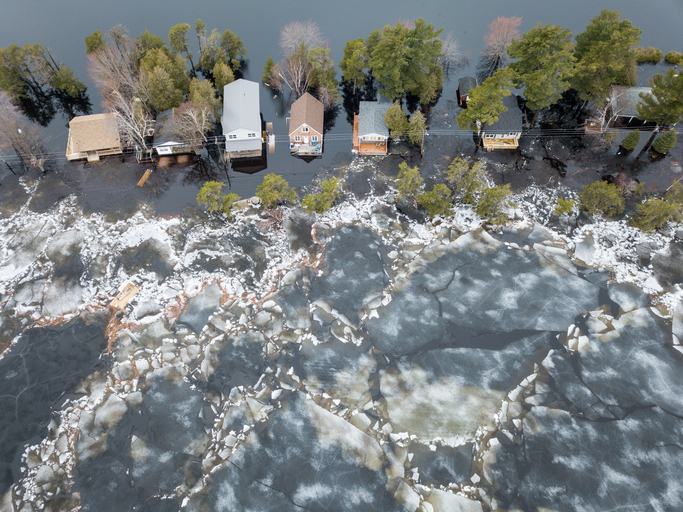

As rivers swollen by Hurricane Sally’s rains have devastated parts of the Florida Panhandle and south Alabama, the storm’s remnants are forecast to spread the flooding to Georgia and the Carolinas.

Many of the properties damaged will doubtless be found to be uninsured, compounding homeowners’ misery.

A well-known coverage gap

The flood insurance protection gap has been well documented. A recent Triple-I paper – Hurricane Season: More Than Just Wind and Water – states that “about 90 percent of all natural disasters in the United States involve flooding” and cites experts strenuously urging everyone to buy flood insurance.

“Any home can flood,” says Dan Kaniewski — managing director for public sector innovation at Marsh & McLennan and former deputy administrator for resilience at the Federal Emergency Management Agency (FEMA). “Even if you’re well outside a floodplain…. Get flood insurance. Whether you’re a homeowner or a renter or a business — get flood insurance.”

Dr. Rick Knabb — on-air hurricane expert for the Weather Channel, speaking at Triple-I’s 2019 Joint Industry Forum — is similarly emphatic.

“If it can rain where you live,” he said, “it can flood where you live.”

Despite such warnings, even in designated flood zones, the protection gap remains large. A McKinsey & Co. analysis of flood insurance purchase rates in areas most affected by three Category 4 hurricanes that made landfall in the United States — Harvey, Irma, and Maria — found that as many as 80 percent of homeowners in Texas, 60 percent in Florida, and 99 percent in Puerto Rico lacked flood insurance.

To make matters worse, a recent analysis by the nonprofit First Street Foundation found the United States to be woefully underprepared for damaging floods. The report identified “around 1.7 times the number of properties as having substantial risk,” compared with FEMA’s designation.

“This equates to a total of 14.6 million properties across the country at substantial risk, of which 5.9 million property owners are currently unaware of or underestimating the risk they face,” the foundation says.

A more recent Triple-I analysis, conducted in advance of Hurricane Sally, found that flood insurance purchase rates in the counties most likely to be affected by the storm were “remarkably low.”

“In Taylor County, Ga., for example, just 0.09 percent of properties are insured against flooding,” Triple-I wrote.

NOT covered by homeowners insurance

Flood damage is excluded under standard homeowners and renters insurance policies. However, flood coverage is available as a separate policy from the National Flood Insurance Program (NFIP), administered by FEMA, and from a growing number of private insurers, thanks to sophisticated flood models that have made insurers more comfortable writing this once “untouchable” risk.

Invest in resilience

If it seems as if you’ve heard me beat this drum before, you’re right. I take flood and flood insurance very personally.

After Hurricane Irene flooded my inland New Jersey basement in August 2011, destroying many irreplaceable items, it was my flood insurance that enabled me to have a French drain and two powerful pumps installed that have since kept my historically damp cellar bone dry – even during Superstorm Sandy the following year.