More Private Insurers Writing Flood Coverage; Consumer Demand Continues to Lag

Jeff Dunsavage, Senior Research Analyst, Triple-I (08/17/2023)

Flood is no longer an “untouchable” risk for private insurers, according to a new Triple-I “State of the Risk” Issues Brief. In fact, data suggests insurers see flood risk as a growing area of opportunity. That’s good news for homeowners who understand the evolving nature of the peril.

For decades, FEMA’s National Flood Insurance Program (NFIP) was practically the only available option for homeowners seeking flood coverage. Improved data, analysis, and modeling have helped drive increased private-sector interest in flood-risk transfer and mitigation.

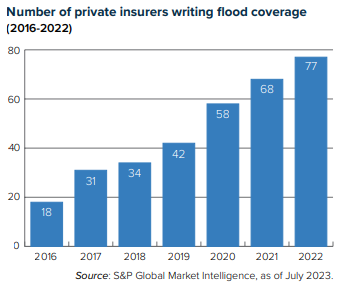

Since 2016, when only 12.6 percent of flood coverage was written by 18 private insurers, the market has grown significantly. In 2022, the total flood market had grown 24 percent – from $3.29 billion in direct premiums written (DPW) in 2016 to $4.09 billion – with 77 companies writing 32.1 percent of the business.

The timing of the private market’s increasing appetite for flood risk is fortuitous, as it coincides with Risk Rating 2.0, NFIP’s new pricing methodology that aims to make the government agency’s flood insurance premium rates more actuarially sound and equitable by better aligning them with individual properties’ flood risk. As NFIP rates become more aligned with principles of risk-based pricing, some policyholders’ prices are expected to fall, while many are going to rise.

It is reasonable to expect that, as the cost of participating in the government-run flood insurance program rises for some, private insurers will recognize the market opportunity and respond by applying cutting-edge data and analytics capabilities, more refined pricing techniques, and new products, such as parametric insurance, to seize those opportunities. It also is incumbent upon communities to explore innovative approaches like community-based disaster insurance programs.

Unfortunately, as risk-management firm Milliman points out, “A relative lack of consumer demand compared to other property insurance offerings still gives carriers hesitation when trying to evaluate whether they should invest in launching their own private flood programs.”

Public education and awareness building around flood risk are essential to advance the goal of reducing flood risk, as is collective action among stakeholder groups – from banks and insurers to community leaders, real estate professionals, and policymakers. Reducing the threat of costly flood claims will be necessary to ensure that affordable insurance protection is available to all who need it.

Triple-I collaborates with its insurer members, other nonprofits, insurtechs, and other partners to promote pre-emptive mitigation and rapid recovery to benefit policyholders, insurers, communities, and businesses. Its Resilience Accelerator provides access to tools and resources, including flood peril maps and webinars featuring leaders in risk and insurance innovation.

Learn More:

Stemming a Rising Tide: How Insurers Can Close the Flood Protection Gap

Climate Risk Isn’t All About Climate: Population, Land Use, Incentives Need to Be Addressed

Coastal Virginia Rises to Meet the Challenge of Sea-Level Rise