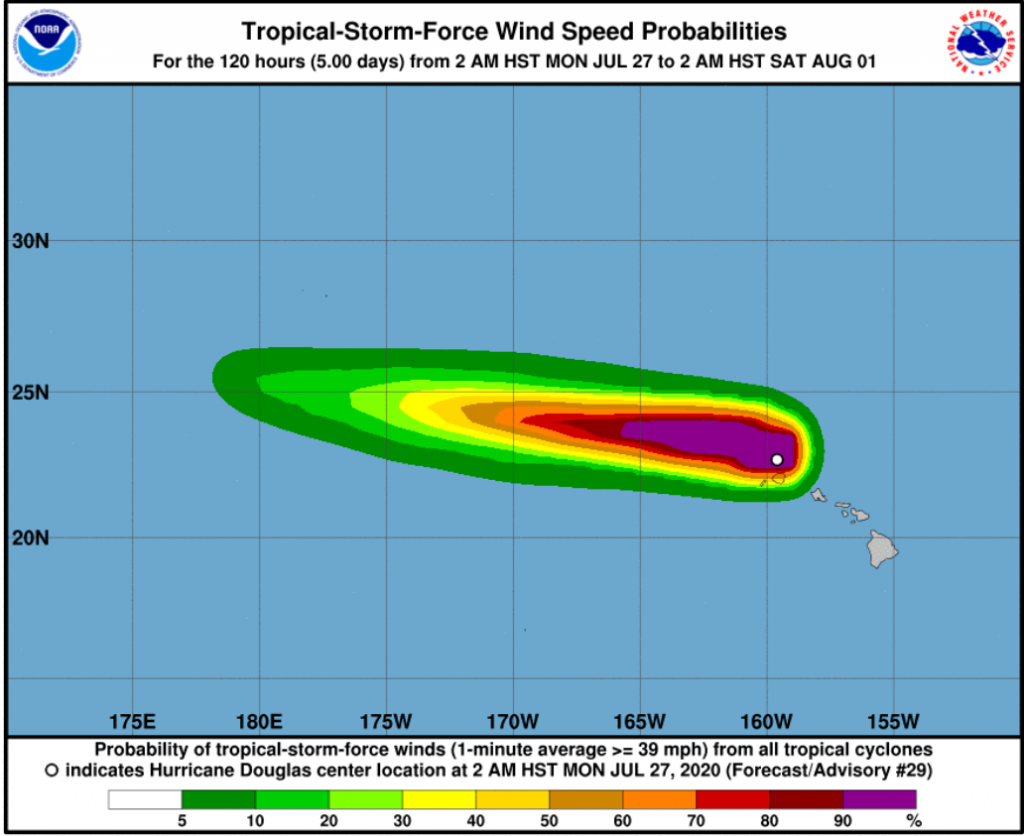

Close call for Hawaii as Hurricane Douglas passes

07/27/2020

Hurricane Douglas brought heavy rain and 90 mph winds to parts of Hawaii on Sunday July 26 as the Category 1 storm passed north of Maui and Oahu, avoiding a direct hit. Some bands of heavy rain with gusty winds did affect both islands.

Although landfalling hurricanes are rare in Hawaii, residents are still advised to know what to do before, during and after a hurricane.

Hawaii

homeowners and renters insurance policies usually provide coverage for almost

all standard perils (e.g., fire, explosion) and liability; however, some

policies exclude hurricanes.

In Hawaii, homeowners

and renters generally purchase hurricane and flood insurance policies

separately to

protect their property from those specific natural disasters and supplement

their homeowners and renters insurance policies.

“In addition to encouraging consumers to buy the appropriate coverage, the

Triple-I has been outspoken about the need to bridge the flood insurance

coverage gap and build more resilient communities through its Resilience Accelerator,” said Sean Kevelighan, CEO, Insurance Information

Institute. “In fact, the average take-up rate for flood insurance in the entire

state of Hawaii is 12.6 percent, which is an alarming recovery gap for

citizens.”

Only a flood

insurance policy, available through FEMA’s National Flood Insurance Program (NFIP)

and some private insurers, can protect a homeowner, renter, or business from

flood-caused property damage. Most U.S. natural disasters involve flooding, and

standard homeowners, renters, and business policies do not cover flood-caused

damage.

An auto insurance policy’s optional

comprehensive provision covers wind, hurricane, and flood-caused property damage to

vehicles.